I’ve been paying my taxes for a long time now but to be completely honest I never had any idea how it all actually worked. My tax information isn’t very complicated. It’s me and Stephanie’s W-2s and a couple other minor things so there’s not much to them. Most years I punch in a few numbers into TurboTax and like magic it shows me a couple of green amounts that end up being refunds. It usually wasn’t that much, like around $1,000 or so but over the years I’ve grown to really like refunds.

What Are Those Red Numbers?

But unfortunately this year’s taxes were a little different. After punching in the tax numbers into the assigned boxes the upward scrolling numbers on my screen weren’t green, they were red. Not good and first I thought there was something wrong with TurboTax. I changed a few of the numbers that I thought might have been the problem and the scary red dollar amounts didn’t budge.

Was it possible that we owed money on our taxes this year? It didn’t make a whole lot of sense to me but like I said, I didn’t really understand how taxes worked at this point. I just punched in the numbers TurboTax told me to and like magic it would tell me how much money I was going to get back. It used to be like Christmas in April but this time around it wasn’t going so well.

After the shock wore off I decided to do some research into why we owed so much money and how this could have happened to us. After searching around on the internet for a while I quickly learned why we were into the situation in the first place and the mistakes we had made to get us there. I thought it would be good to share some of these learnings so that if any of your are ever in the same situation you can make better decisions than we did.

It’s All About The W-4

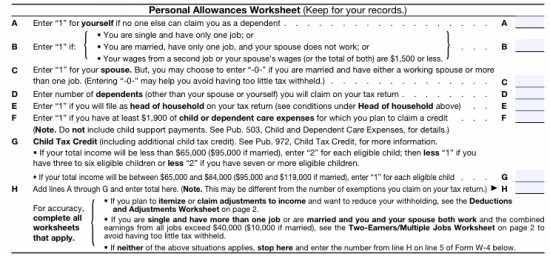

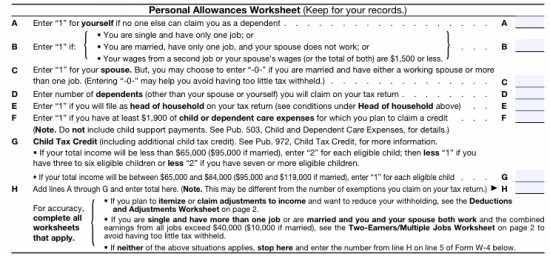

When you first get a salaried job you’re given a W-4 form to fill out. It’s probably one of the most confusing forms you’ll ever see and the more you read it the more confused you will become. I’m not sure what robot was assigned to write the copy for this thing but it’s a doozy.

However, believe it or not the purpose of a W-4 is not to confuse you or make you feel stupid. It’s there to help you tell whoever’s doing your payroll how much money to take out of your paycheck each month for taxes. The money they take out is called withholding allowance and what you choose on your W-4 will determine how much they withhold each time you get paid. The amount that is withheld eventually ends up on your pay stub under the taxes section (always our favorite part).

The most common way to determine your withholding is by choosing exemptions, which you can select on the W-4. These include single, married, kids (dependents), low wages and so on and the more you choose the less you’ll be taking out of your check each payday. These exemptions are then added up and the total number of exemptions you have will then determine how much you’ll be withholding each time you’re paid.

The more exemptions you choose, the larger your paycheck it going to be but the less you’re going to be paying in taxes during the year. This is great short-term but it can come back to bite you later and this is what happened to me and Stephanie. We both filed as married on our W-4s which meant we were withholding less taxes than we should have. Mix that and a few other factors like getting paid more this year than last year and we still owed Uncle Sam a good chunk of change (and Uncle Sam always gets what he wants).

Understanding Your W-4

I guess what I’m saying is be sure to do the right thing on your W-4 and you should be ok. Now that we both know this neither of us are claiming any exemptions which should help even everything out. Who knows, maybe we’ll get another refund next year?

If you need an easy way to figure out how much you’re withholding simply divide your total taxed income (do it for both Federal and State Taxes) by how much total income you’ve brought in year to date. For example, if you have earned $10,000 and have paid $1,000 in federal taxes then you’re withholding 10% of your earnings on the federal side. Do the same thing for your state taxes and you’ll know your the total amount of withholdings.

The next thing you need to do is figure out what federal and state tax bracket you’re in and if your tax bracket percentage is higher than what you’re withholding from your earnings each month then you’re going to owe the tax man at the end of the year just like I do. On the other hand if you’re withholding more from your earnings than what’s required by your combined federal and state tax brackets then be ready for Christmas in April because you’re going to get a refund.

Let’s Go Over This One More Time

Just to be clear let me go over this one more time. If you’re withholding 10% of your earnings for federal taxes and you’re in a tax bracket that’s 20% then you’re going to end up owing back 10% of your total yearly earnings to the federal government at the end of the year. Believe me, you don’t want to do this. It’s not a lot of fun.

The easiest thing to do, even if you’re married, is to claim yourself as single on your W-4. That way you’ll be withholding more than enough from your earnings during the year and you won’t have to worry about it. If you’re making an obscene amount of money you might want to take out even more but if that’s how you’re rolling you’ve already hired a good CPA to take care of this in the first place.

I hope this is helpful because the last thing I want to happen to you is what happened to me. No one likes to owe taxes and if you follow this advice you should never have to. If you have any thoughts, questions or corrections on this topic of taxes feel free to let me know, I’m learning just like you are.